Discover The Good in Banking™

-

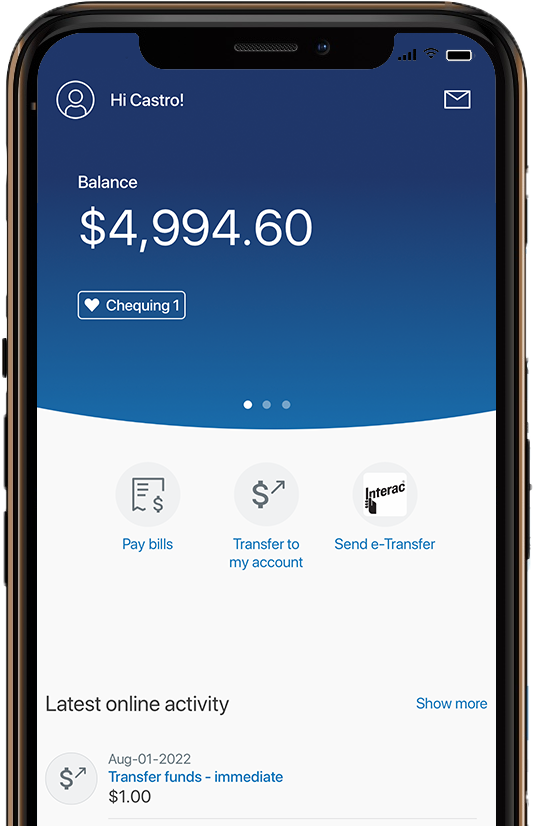

Good is freedom. At Alterna, our fully digital Small Business Banking Solution lets you focus on your business, not your banking.

-

Good is hassle-free. Joining is fast and easy and that's just the beginning. From your mobile device or online you have access to Alterna Bank 24/7.

-

Good is value. Our day-to-day account is $5 a month or free with a minimum monthly balance of $3000.

-

Good is knowing you. We have a long-standing history of supporting small businesses and entrepreneurs thorugh our award-winning Micro-Finance program.

-

Good is innovation. We're proud to partner with leading-edge fintech companies who bring expertise in account opening and integrated transactions.

-

Good is promise. We promise to keep innovating, to play fair and to be the champion of small business everywhere.